what is sensitivity analysis and how is it used in regard to the npv method?

What is Sensitivity Analysis?

Sensitivity Analysis is a tool used in fiscal modeling to clarify how the different values of a set of contained variables bear on a specific dependent variable under certain specific atmospheric condition. In general, sensitivity analysis is used in a wide range of fields, ranging from biological science and geography to economics and engineering science.

Information technology is peculiarly useful in the study and analysis of a "Black Box Process" where the output is an opaque function of several inputs. An opaque role or process is one which, for some reason, can't be studied and analyzed. For example, climate models in geography are normally very complex. As a effect, the verbal human relationship between the inputs and outputs are non well understood.

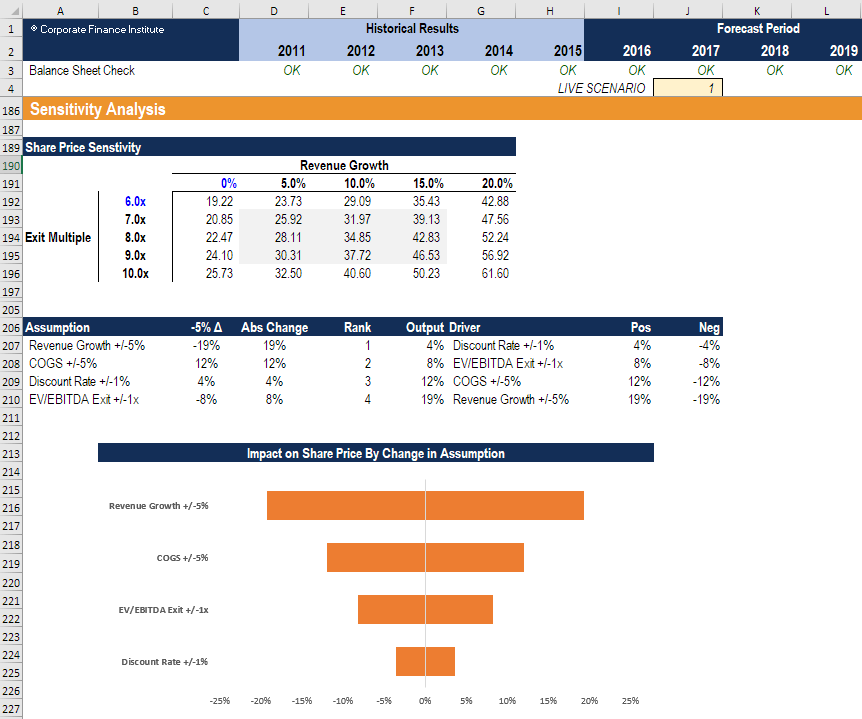

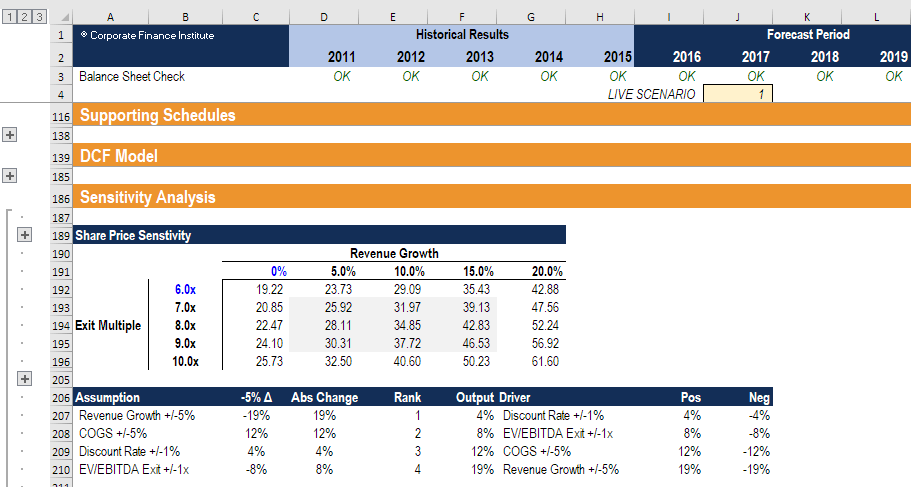

Image from CFI'south Scenario & Sensitivity Analysis in Excel Class

What-If Analysis

A Financial Sensitivity Analysis, likewise known every bit a What-If analysis or a What-If simulation exercise, is nearly ordinarily used by fiscal analysts to predict the event of a specific action when performed nether certain weather condition.

Financial Sensitivity Analysis is done within defined boundaries that are determined by the ready of independent (input) variables.

For example, sensitivity analysis tin can be used to study the effect of a change in interest rates on bond prices if the involvement rates increased by 1%. The "What-If" question would be: " What would happen to the price of a bail If interest rates went upwards by 1%?". This question can be answered with sensitivity analysis.

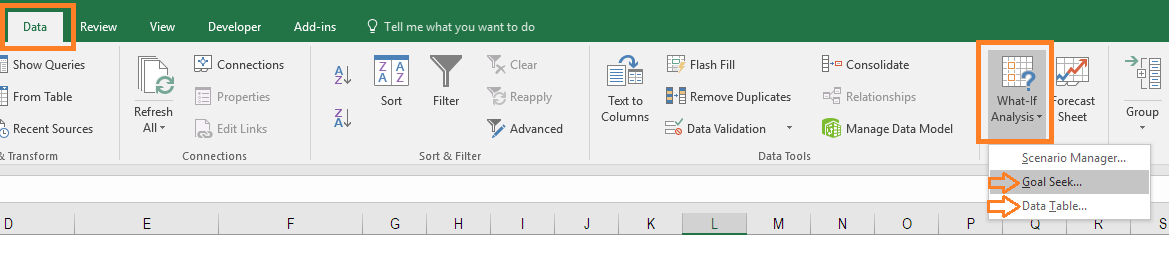

The analysis is performed in Excel, nether the Data section of the ribbon and the "What-if Assay" push button, which contains both "Goal Seek" and "Data Table". These functions are both taught step-past-step in our free Excel Crash Course .

Sensitivity Analysis Case

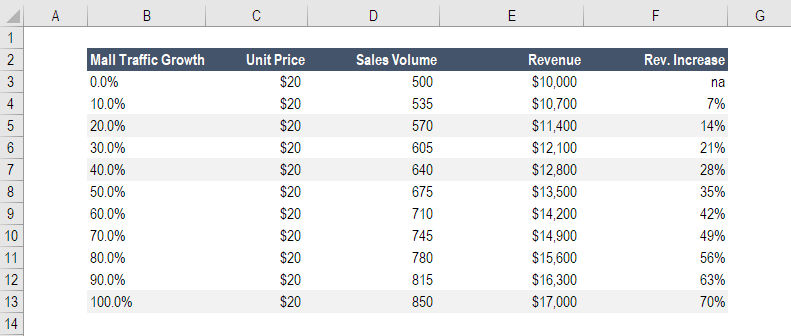

John is in charge of sales for Vacation CO, a business organization that sells Christmas decorations at a shopping mall. John knows that the holiday season is approaching and that the mall volition be crowded. He wants to find out whether an increment in customer traffic at the mall will raise the total sales revenue of Vacation CO and, if and so, then by how much.

The boilerplate price of a package of Christmas decorations is $twenty. During the previous year'due south vacation season, HOLIDAY CO sold 500 packs of Christmas decorations, resulting in total sales of $10,000.

After carrying out a Fiscal Sensitivity Analysis, John determines that a 10% increment in client traffic at the mall results in a 7% increase in the number of sales.

Using this information, John can predict how much money company XYZ will generate if customer traffic increases by xx%, 40%, or 100%. Based on John'south Financial Sensitivity Analysis, such increases in traffic will issue in an increase in acquirement of xiv%, 28%, and 70%, respectively.

Learn how to build a table like this in our Costless Excel Crash Grade !

Download the Free Template

Enter your proper noun and email in the form beneath and download the free template now!

Sensitivity Analysis Table

Download the gratis Excel template now to advance your finance cognition!

Sensitivity Assay vs. Scenario Analysis

It is important not to misfile Financial Sensitivity Analysis with Financial Scenario Analysis. Although similar to some caste, the two take some key differences.

Sensitivity Analysis is used to empathize the effect of a set of independent variables on some dependent variable under sure specific conditions. For case, a financial analyst wants to find out the consequence of a visitor's net working capital on its profit margin. The assay will involve all the variables that have an bear upon on the visitor'south profit margin, such as the toll of goods sold , workers' wages, managers' wages, etc. The analysis volition isolate each of these fixed and variable costs and record all the possible outcomes.

Scenario Analysis, on the other hand, requires the fiscal annotator to examine a specific scenario in detail. Scenario Assay is usually done to analyze situations involving major economic shocks, such as a global market shift or a major alter in the nature of the business concern.

After specifying the details of the scenario, the annotator would then have to specify all of the relevant variables, then that they align with the scenario. The result is a very comprehensive motion picture of the future (a discrete scenario). The analyst would know the full range of outcomes, given all the extremes, and would take an agreement of what the various outcomes would be, given a specific set of variables defined by a specific existent-life scenario.

Advantages of Financial Sensitivity Analysis

In that location are many of import reasons to perform sensitivity assay:

- Sensitivity analysis adds credibility to any type of fiscal model by testing the model across a wide fix of possibilities.

- Financial Sensitivity Analysis allows the analyst to exist flexible with the boundaries within which to test the sensitivity of the dependent variables to the contained variables. For example, the model to study the consequence of a 5-bespeak modify in interest rates on bail prices would exist dissimilar from the fiscal model that would exist used to study the result of a 20-point alter in interest rates on bond prices.

- Sensitivity assay helps one brand informed choices. Decision-makers use the model to understand how responsive the output is to changes in certain variables. Thus, the annotator can be helpful in deriving tangible conclusions and exist instrumental in making optimal decisions.

Best Practices in Sensitivity Analysis

#1 Layout in Excel

Layout, structure, and planning are all important for good sensitivity analysis in Excel. If a model is not well organized, then both the creator and the users of the model volition be confused and the analysis will be decumbent to error.

The most important points to keep in listen for layout in Excel include:

- Place all assumptions in ane area of the model

- Format all assumptions/inputs in a unique font color so that they are easy to place

- Think carefully nigh what to test – only the almost important assumptions

- Empathise the relationship (correlation) betwixt dependent and independent variables (linear? – nonlinear?)

- Create charts and graphs that enable users to easily visualize the data

- Create a separate surface area for the analysis by using group (see instance below)

#2 Direct versus indirect methods

The direct method involves substituting different numbers into an supposition in a model.

For example, if the revenue growth supposition in a model is ten% year-over-yr (YoY ), then the acquirement formula is = (last twelvemonth revenue) x (1 + x%). In the straight approach, we substitute dissimilar numbers to supersede the growth rate – for example, 0%, 5%, 15%, and 20% – and encounter what the resulting acquirement dollars are.

The indirect method (as shown below) inserts a percent change into formulas in the model, instead of direct changing the value of an assumption.

Using the same instance as above, if the revenue growth assumption in a model is x% twelvemonth-over-year (YoY ), then the revenue formula is = (concluding year revenue) x (one + 10%). Instead of changing 10% to another number, we can change the formula to be = (terminal year revenue) ten (1 + (x% + X)), where Ten is a value contained down in the sensitivity assay area of the model.

Learn how to do this step-past-step – launch our sensitivity analysis form now!

#iii Tables, charts, and graphs

Sensitivity assay can exist challenging to comprehend fifty-fifty past the most informed and technically savvy finance professionals, so information technology's important to be able to express the results in a manner that'due south easy to comprehend and follow.

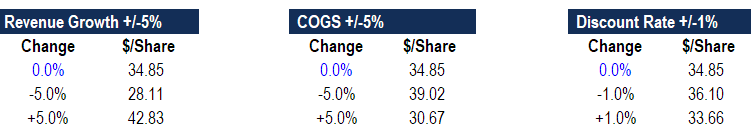

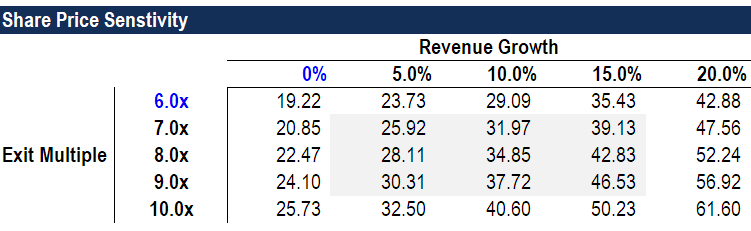

Information tables are a great fashion of showing the impact on a dependent variable by the changing of up to 2 independent variables. Below is an example of a data tabular array that clearly shows the impact of changes in revenue growth and EV/EBITDA multiple on a company's share price.

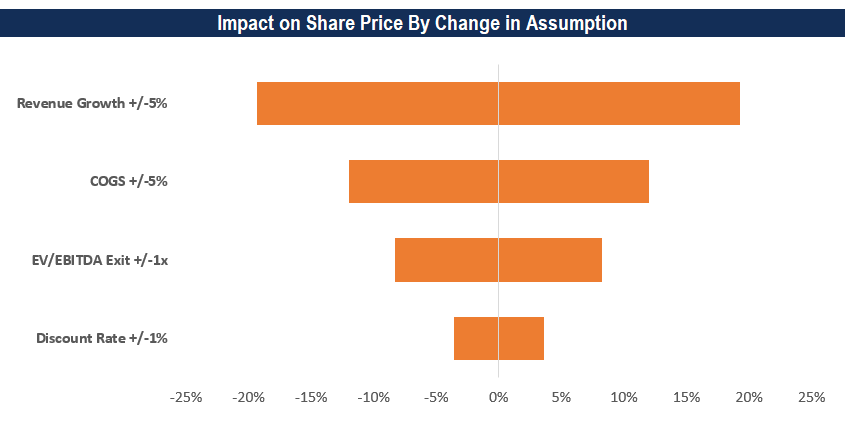

Tornado Charts can be a great way of showing the impact of changes to many variables at once. They are called Tornado Charts considering they are sorted, from the nearly impactful to to the lowest degree impactful, in a fashion that shapes the chart like a tornado cone. To acquire how to build these charts, launch our sensitivity analysis in Excel course now!

Video Explanation of Sensitivity Assay

Watch this short video to quickly empathise the primary concepts covered in this guide, including the Direct and Indirect methods.

Related manufactures and guides

Thanks for reading this guide to sensitivity assay. To acquire more well-nigh financial modeling, these costless CFI resources will be helpful:

- Scenario Analysis

- Assay of Financial Statements

- DCF Modeling Guide

- Financial Modeling All-time Practices

Source: https://corporatefinanceinstitute.com/resources/knowledge/modeling/what-is-sensitivity-analysis/

Postar um comentário for "what is sensitivity analysis and how is it used in regard to the npv method?"